In this guide we will look at how to write off an invoice in Hoowla. If you raise an invoice which subsequently will not be paid then you can choose to write off that amount of money owed to the business. This will reverse the invoice in your client office ledger and post to your designated write off nominal.

If you wish to write off an invoice first you’ll need to go to the client’s ledger where the invoice was raised. Here are 2 typical ways to find the clients ledger.

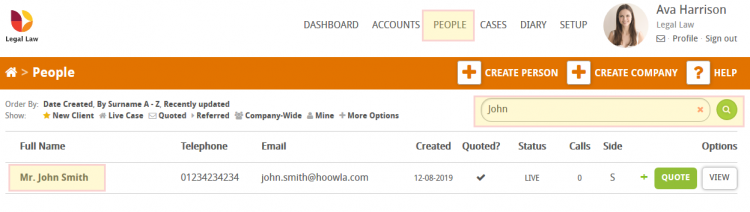

How to access client ledger from the People List

Search for the client in your people list; click on People link next to your name. In the search box on the right enter your client’s name. Once you’ve found your client in the list, click on their name to access their person record.

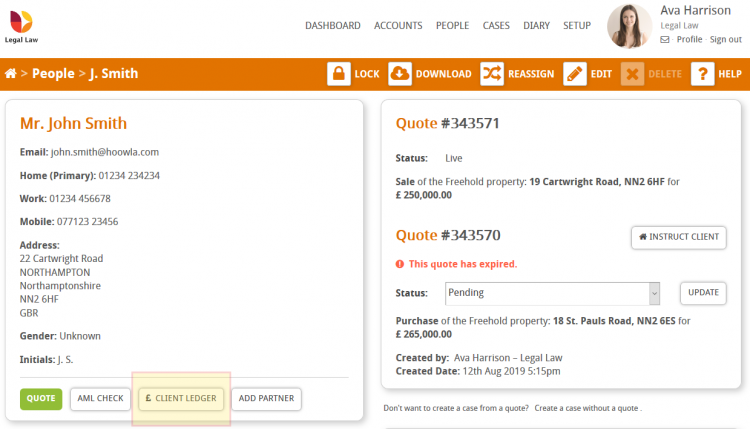

Once in your client’s Person Record click the Client Ledger button on their Person Card to take you into their ledger.

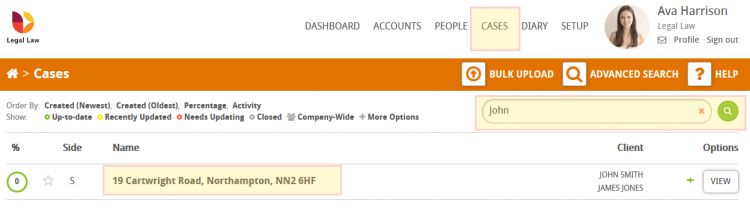

How to access client ledger from a case

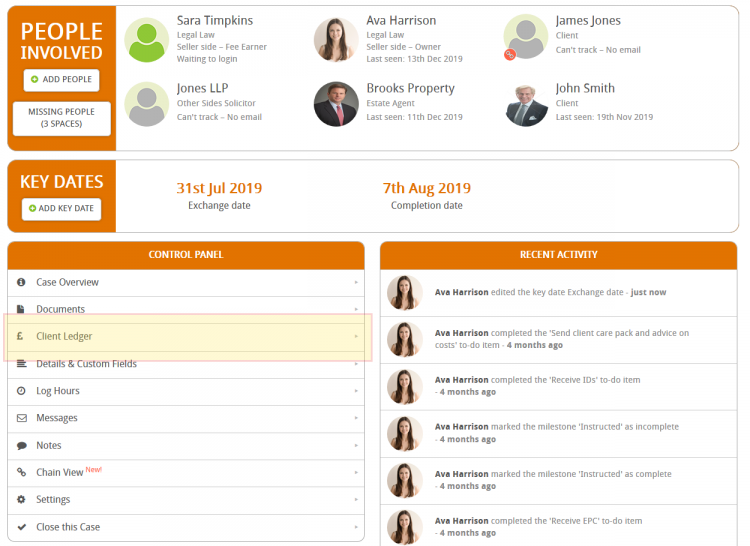

Alternatively, you can access the client’s ledger via their case. Click on the Cases link at the top of Hoowla then enter the client’s name, case name/property address or case reference number into the search box in the top right. Once you’ve found the case in the list, click on its name to access the case.

Once in the case, scroll down to the control panel and click on view client ledger.

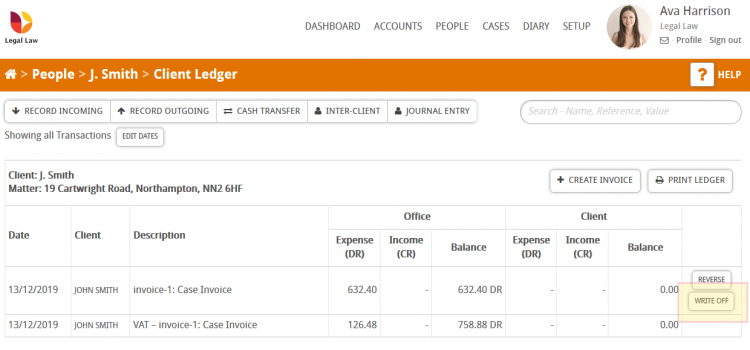

Once in the client’s ledger, find the invoice in question and click the write off button.

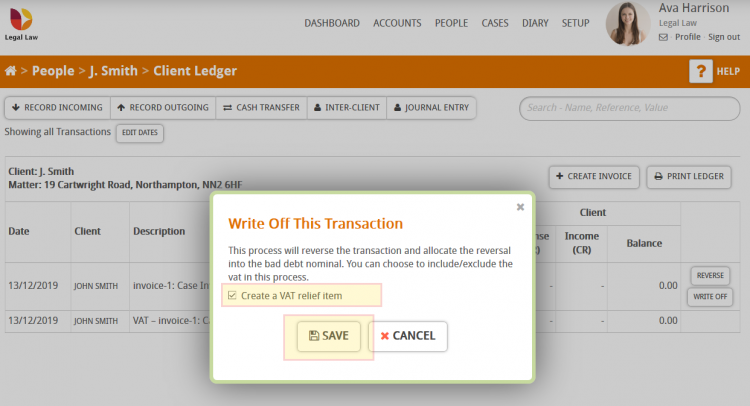

You will be prompted to confirm that you wish to write off this invoice. If you wish to include VAT relief with the reversal then tick create a VAT relief item.

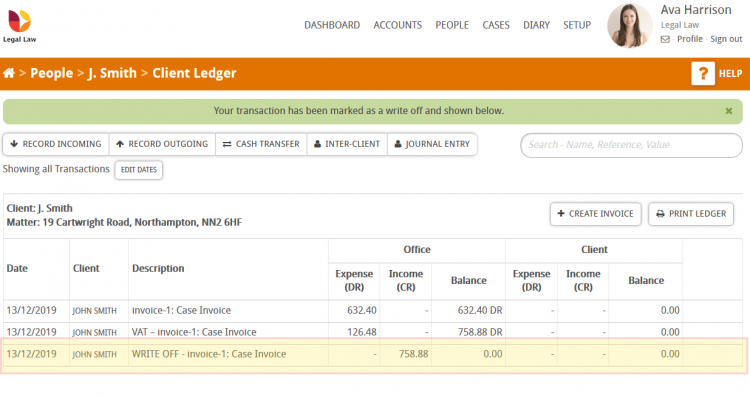

When you press save you will see that invoice reversed with the amount credited to the office side of the ledger and the balance updated accordingly.

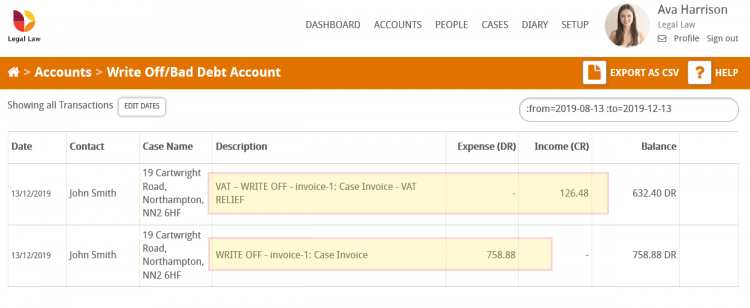

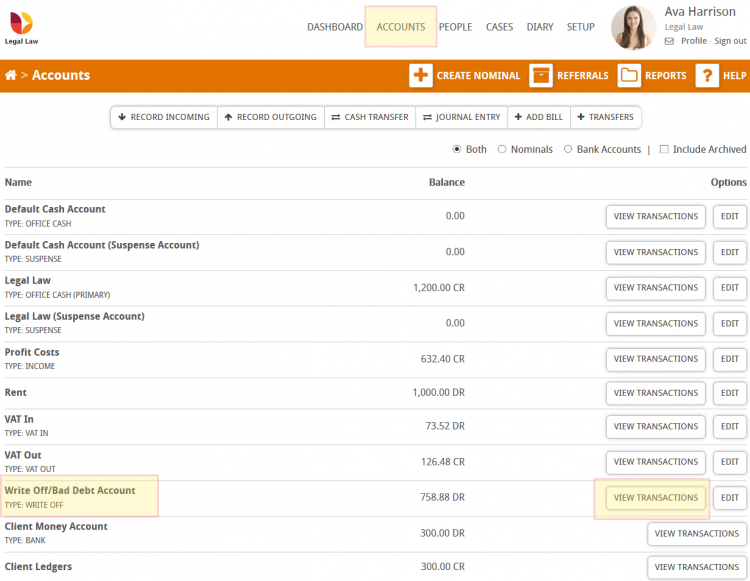

A posting will also have been made to your assigned write off nominal. To view transactions in your write off nominal click on ACCOUNTS at the top of Hoowla then find the nominal that’s been assigned the type “write off” in the list and click view transactions.

This will display all of the transactions you have posted to your write off nominal. In the example below, we can see the invoice amount has been posted as a debt and because we ticked to include VAT relief, the VAT portion of the invoice has been posted as a credit.