Hoowla seamlessly integrates with HMRC, allowing you to submit Stamp Duty (SDLT) forms through your Hoowla account, from the case. In this guide we will look at how to connect your firm’s HMRC account up to your Hoowla account.

Note: See this guide on how to Submit Stamp Duty (SDLT) to HMRC and Obtain an SDLT5 Certificate.

Click the Setup link next to your name.

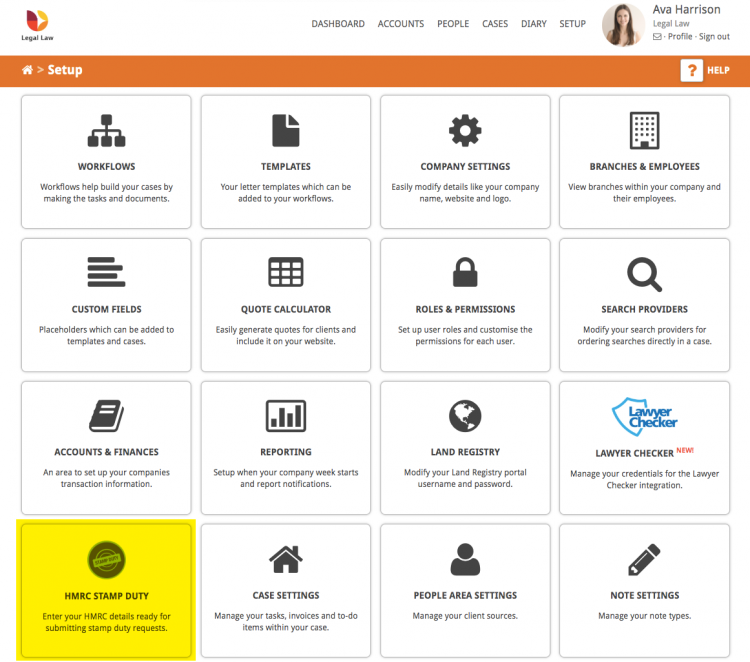

Click the HMRC Stamp Duty button

Important Note: if you cannot see the HMRC Stamp Duty button in setup then you do not have permission to edit these settings on your user account. Speak with your office manager or contact Hoowla on 01792 687146 for further details.

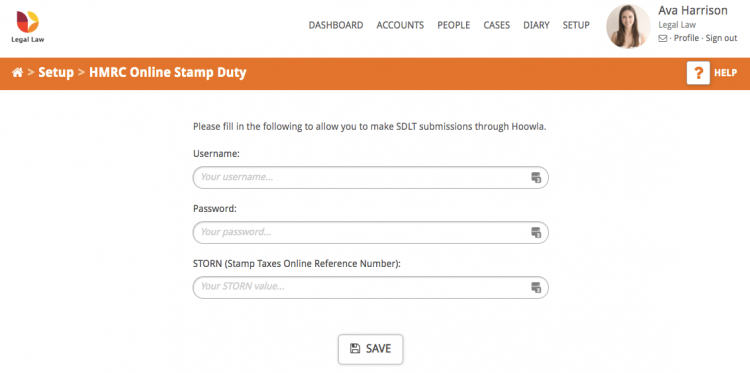

Enter in your firm’s HMRC username, password and STORN (Stamp Taxes Online Reference Number) and then click the Save button.

- Typically your firm’s username will be a 12 digit number.

- Typically your firm’s STORN (Stamp Taxes Online Reference Number) will be a 10 digit number.

If you have difficulties finding these details then please contact HMRC.