This guide will look at what you need to update in Hoowla once you become VAT registered.

- Update Company Settings

- Update your Quote Calculators

- Check any invoices that have been generated between the day you became VAT registered and the day you let your Hoowla system know you are VAT registered

Update Company Settings

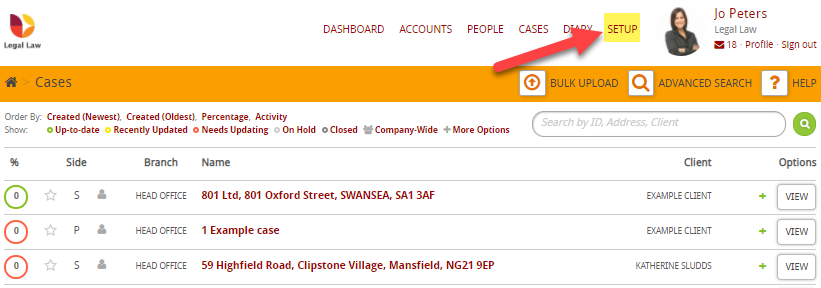

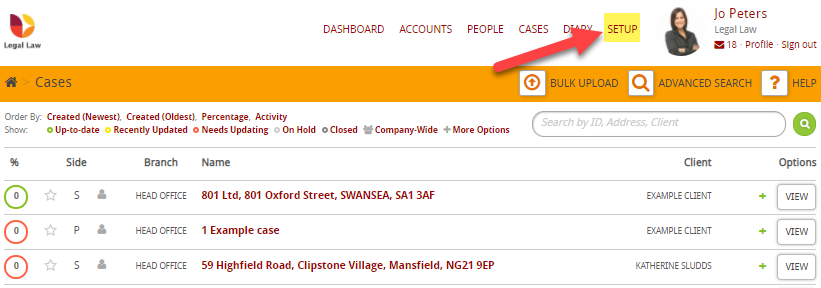

Click Setup

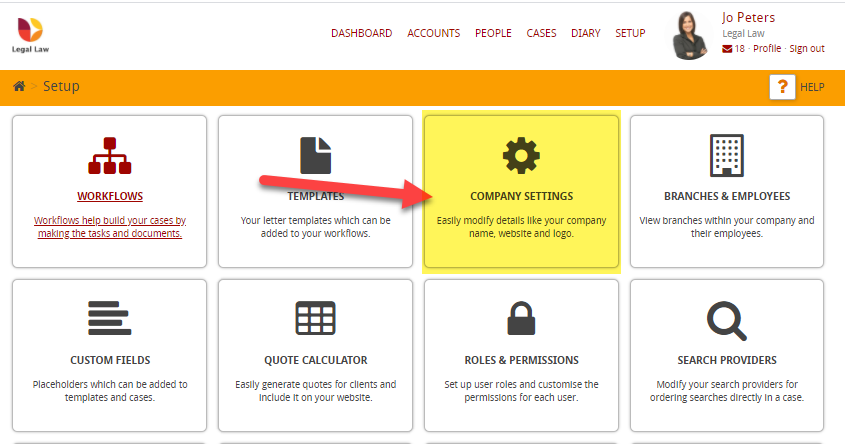

Then Company Settings

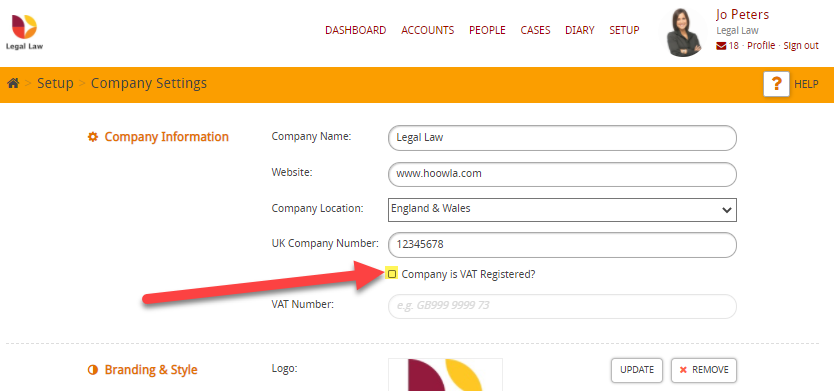

On this page, you will need to tick the box next to Company is VAT registered?

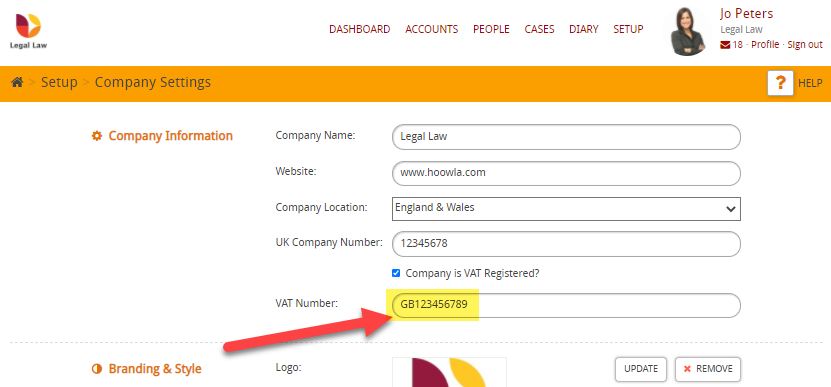

Then enter your VAT number:

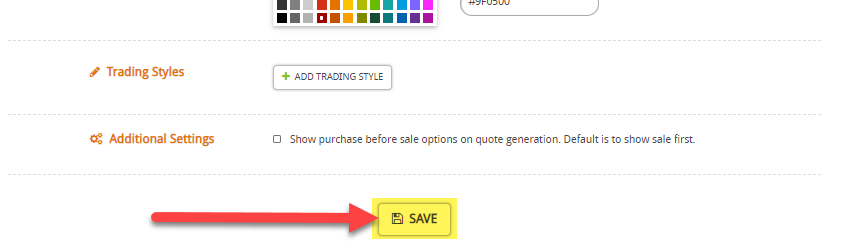

Then press Save

Update your Quote Calculators

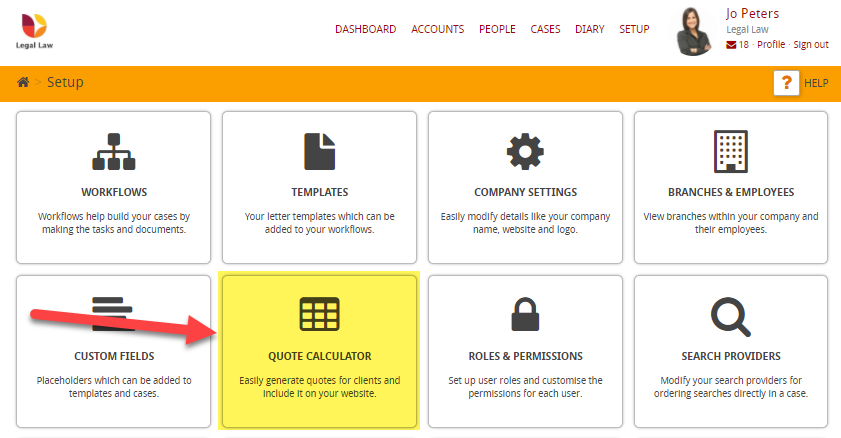

Click on Setup

Then Quote Calculator

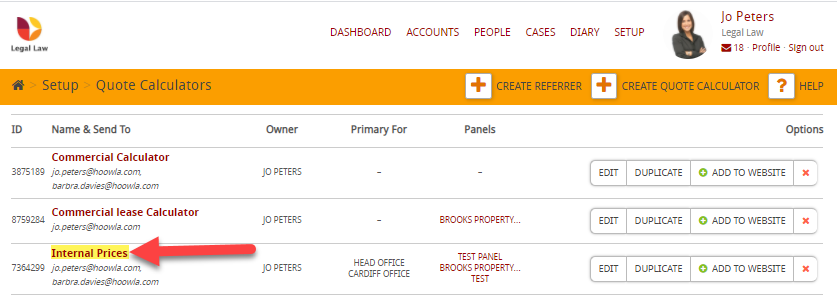

Choose the calculator, for this example, I’m going to select Internal Prices

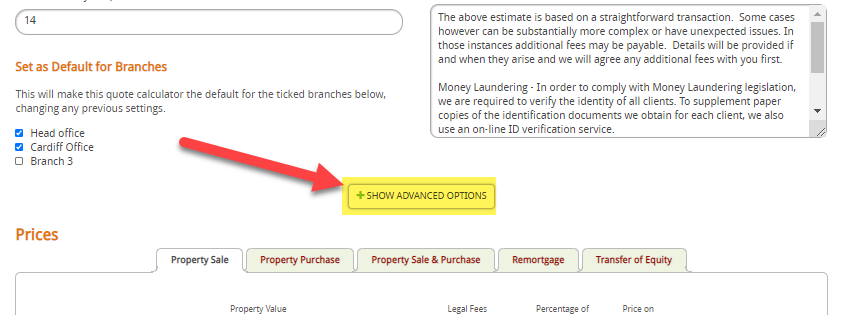

Then scroll down and click on Advanced Options

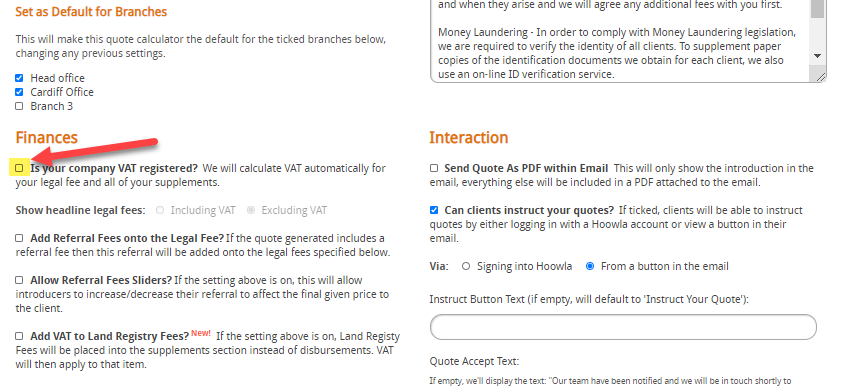

You will see under Finances, a tick box next to Is your company VAT registered?, tick the box in order for VAT to be calculate automatically for you

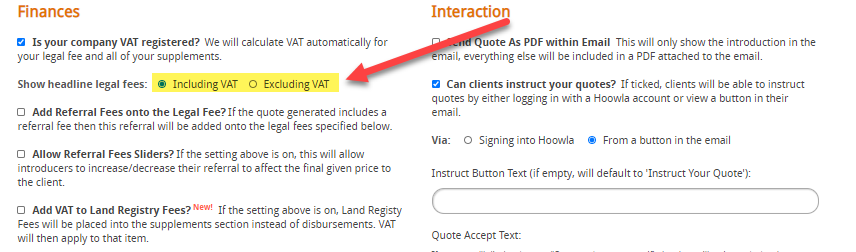

Then choose whether you want your Headline Legal fees to include or exclude VAT

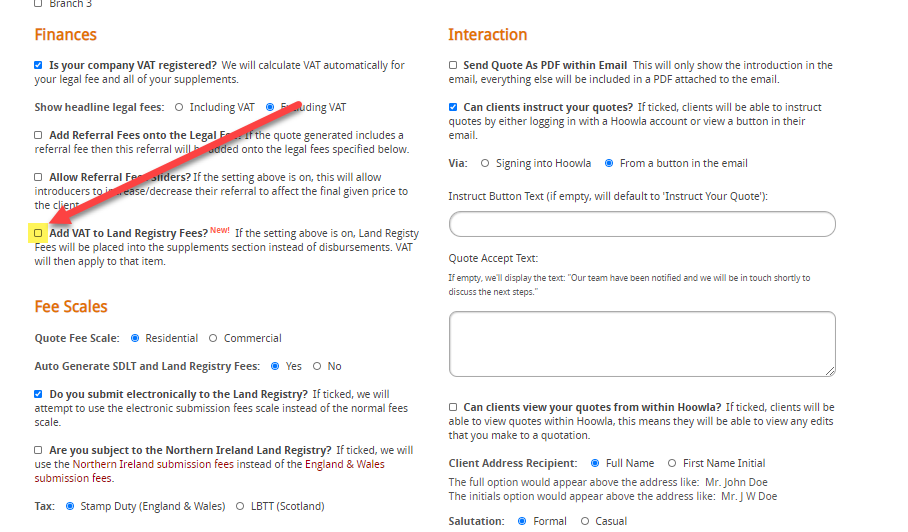

Another optional setting is if you want to add VAT to Land Registry Fees, if you do then simply click the tick box next to Add VAT to Land Registry Fees?

Check invoices

Once you have updated Hoowla then any invoice going forward will automatically take in account that you are VAT registered. However, it is recommended that you check all invoices are checked between the day that you are VAT registered and the day that you update Hoowla that you are now VAT registered.